Is a New TAX coming your state?

Long-Term Care

Take charge of your life, plan your future, and have peace of mind

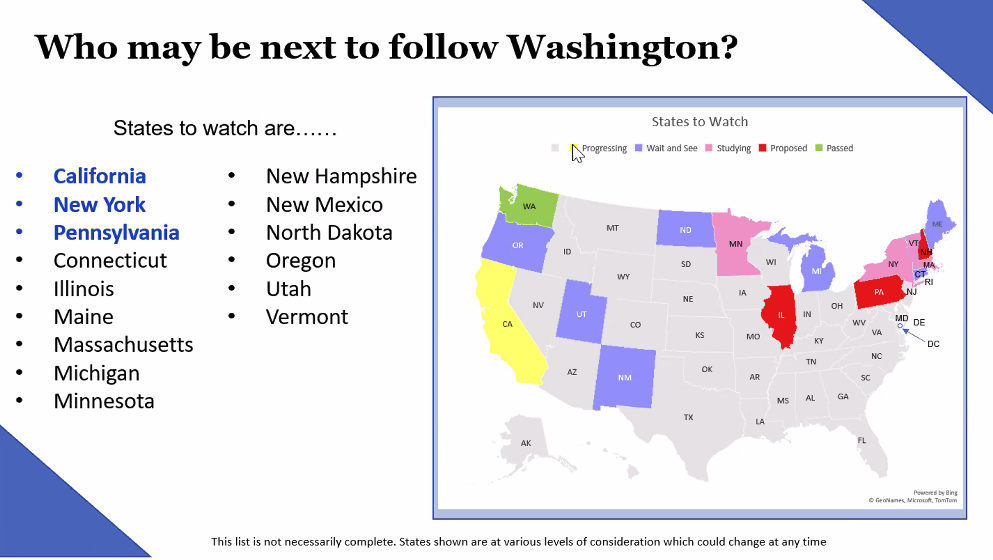

What’s going on with Long Term Care in other States?

(as of September 8, 2023)

“If I don’t do anything, what happens?”

Remained informed.

Keep an eye on the progress of any possible Long-Term Care updates within your state and decide for yourself if when or what is the best time to take action. Ignorance is NOT bliss.

Let’s look at Washington State.

0.58% are taken from payrolls. The range is wide, but in general terms, some are paying roughly $100 a year, and some could be paying at least $5,000 a year. Both will get a benefit of $36,500 LIFETIME BENEFITS. Read more here.

With your own private Long-Term Care* plan, you can get at least $100,000 benefits and it can be a whole lot more FLEXIBLE!

Not all Long-Term Care policies will be exempt from any possible state taxation. Please refer and review your State’s Long-Term Care requirements. California Long Term Care Insurance Task Force reference here. For Washington state, please see this link.

Long-Term Care (LTC)

Take charge of your life, plan your future, and have peace of mind

What is Long-Term Care (LTC)?

Long-term care (LTC) refers to a range of services and supports needed by individuals who have chronic health conditions or disabilities. These services are typically not focused on curing the underlying health issues but rather on assisting with Activities of Daily Living (ADLs) and providing necessary care and support over an extended period.

California Department of Insurance defines Long-Term Care

California’s Current Task-Force

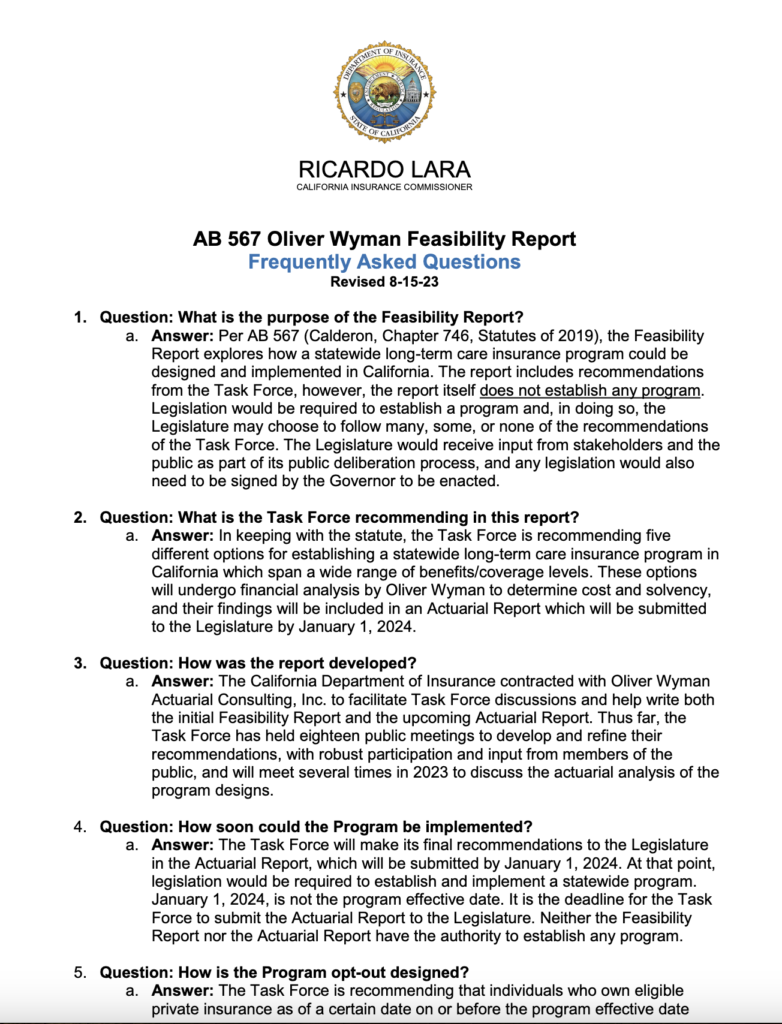

California Assembly Bill 567

https://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=201920200AB567

AB 567, Chapter 746 – Frequently Asked Questions

Who Pays for Long-Term Care Expenses?

Medicare

- Requires 3-nights hospital stay (admitted)

- First 20 days, full cover

- 21-100 days, co-pay

Anything that is not covered by Medicare has to be paid out-of-pocket.

Medicaid (Medi-Cal in CA)

- Must show proof of impoverishment at a time of claim

- Assets must be less than $2,000 (varies by state)

- 5-year look-back on assets to qualify

The government decides who and what is considered as a low income. Refer to your local county or state for more information.

https://www.dhcs.ca.gov/services/medi-cal/Pages/DoYouQualifyForMedi-Cal.aspx

Family Savings/Investments

- Personal Savings

- Real Estate Properties

- Retirement Accounts

- Other Investment Accounts

The middle-class is mostly affected. Because we’re not too poor to qualify for government benefits, and make enough to live a tad bit comfortable.

Long-Term Care (LTC) Plans

- Stand-alone

- Reimbursement via receipt of acceptable & approved services

- Use it or lose it

- Linked-Benefits

- Life Insurance with LTC Rider

- Cash Indemnity after physician confirmation of LTC needs

- Unused benefits can go to beneficiaries

Long-Term Care coverage can help provide for options and resources not typically available through Medicare or Medicaid. Note that different providers and LTC plans can have varying requirements. Some have certain requirements like 90-Day Elimination Period, Proof of Loss, Plan of Care, etc.

Insurance can be a smart way to manage unexpected situations that can significantly affect your finances.

With how the economy is and has been, we can see the growing debt in the United States is accumulating (see https://www.usdebtclock.org/). Part of the growing debt liabilities are government programs intend to help and support individuals and families especially low-income families.

Because of depleting government budget, and increasing expenses and debt, it makes sense why the government thinks it is a great idea to passed the responsibilities to the citizens to help manage the Long-Term Care needs via Long-Term Care Tax – hence California Assembly Bill 567 (AB 567).

Triggers of Long-Term Care

Long-Term care services may include assistance with tasks such as bathing, dressing, eating, using the bathroom, and other activities that individuals may struggle with due to age, illness, or disability. These services can be provided in various settings, including nursing homes, assisted living facilities, adult day care centers, or at home with the help of caregivers.

If you cannot do ANY TWO out of these six ADL Tasks below or has a severe cognitive impairment, it can qualify you to receive Long-Term Care benefits.

Note: Must be assessed by a Licensed Healthcare Practitioner.

Activities of Daily Living (ADL)

Activities of Daily Living (ADLs) are basic everyday tasks that are necessary for independent living at home or in the community.

Eating

Being able to eat by yourself

Transferring

Being able to move from one place to another (from one room to another, etc)

Bathing

Being able to bathe and clean yourself – whether you sound good singing in the shower or not

Dressing

Being able to dress yourself without assistance

Bathroom

Being able to use the bathroom without needing help from someone or something else

Continence

Being able to control your bowel movements

Long-Term Care needs are triggered by any of the following:

- Needs assistance with any 2 out of 6 Daily Living Activities stated above -OR-

- Severe Cognitive Impairment

- If the assistance needed is for more than 90 Calendar days

A stroke, arthritis, diabetes, MS, ALS, Parkinson’s disease, other chronic conditions, a car accident or any common accident like falling of a ladder can have consequences that can also trigger Long-Term-Care besides old age.

People do not plan to fail

But MOST people fail to plan

There are 0.33% chances someone will get into a car accident. There are 75% chances that the same person will NEED Long-Term Care. And so far there’s 100% chances we are all eventually going to die. Are you WELL COVERED? Are your legacy prepared?

Real people sharing their stories (Unscripted)

Thomas and Lorene’s caregiving story

“For high school sweethearts Thomas and Lorene, family is more important than anything. After caring for their own parents, both realized the importance of easing the strain of caregiving for their own children and how having a plan in place could help.”

Cheryl’s caregiving story

“Cheryl actively participates in her community and helped care for her mom at her home. When her mom’s condition worsened, Cheryl had to move her to a skilled nursing home. Luckily the facility was only a couple minutes away, so Cheryl could see her every day and share precious moments together.”

Lisa’s caregiving story

“As an in-home care provider, Lisa is used to caring for people. But things are different with family. After her mom’s surgery, Lisa knew she’d be the one to continue to care for her.”

Importance of Long-Term Care Insurance

- Financial Protection:

- Long-term care can be expensive, and the costs are often not covered by traditional health insurance or Medicare. Long-term care insurance helps provide financial protection by covering the costs associated with nursing home care, assisted living, in-home care, and other long-term care services.

- Preservation of Assets:

- Without long-term care insurance, individuals may need to use their savings or sell assets to cover the costs of care. Long-term care insurance helps preserve assets by providing a dedicated source of funding for long-term care needs.

- Choice of Care Setting:

- Long-term care insurance can provide individuals with the flexibility to choose where they receive care, whether it’s in a nursing home, an assisted living facility, or at home with the assistance of caregivers.

- Reduced Burden on Family:

- Family members often become caregivers when a loved one requires long-term care. Long-term care insurance can help reduce the financial burden on family members and provide resources to hire professional caregivers, allowing family members to focus on emotional and supportive aspects of caregiving.

- Maintaining Independence:

- Long-term care insurance can support individuals in maintaining their independence and quality of life by ensuring access to necessary services without solely relying on family or government assistance.

- Peace of Mind:

- Knowing that there is a plan in place to cover potential long-term care needs can provide peace of mind for individuals and their families. It allows them to focus on enjoying their lives without the constant worry about the financial implications of long-term care.

It’s important to note that long-term care insurance may not be suitable for everyone, and the decision to purchase such insurance depends on individual circumstances, including age, health status, financial situation, and personal preferences. Additionally, policies can vary, so it’s essential to carefully review the terms and coverage options when considering long-term care insurance.

Let us help you find something suitable..

This is a solicitation. A state licensed agent will contact you.